BEV incentives report, international comparison

In this research, the policies of different (European) countries have been analyzed, the effect they have on the Total Cost of Ownership (TCO) has been calculated, and the effect this has on the uptake of battery electric vehicles has been visualized.

Electric car sales

The Netherlands is ahead of most countries in BEV in the total carpark. However, France and Germany are increasing the BEV sales percentage much faster compared to the Netherlands, which saw a declining growth in 2020.

The BEV sales percentage per year show a strong decrease in the Netherlands in Q1 of 2021. This is can be an indication of a decreasing trend, however, it must be said that the Netherlands historically has high BEV sales at the end of the year. The BiK tax is being increased with 4% as of 2022. Similar increases are believed to be the cause of the December-peaks of BEV sales in the past.

Total Cost of Ownership (TCO) comparison

In the Netherlands, the TCO benefit of BEVs over petrol cars is much smaller than in Norway, Germany and France. The private market in the Netherlands is the only market where BEVs are more expensive.

Comparison of budget availability

The budgets presented are predictions, made by ministries or governmental institutions of the country in question, for 2021.

The budgets are sometimes allocated to different timeframes across the different countries, making comparisons difficult. This has been eliminated as much as possible by calculating the budgets for one single year, 2021.

An example of this is the purchase subsidy in the Netherlands. The budget for 2021 has largely been paid out in 2020. For the purpose of this budget comparison, the budget for 2021 has been used.

Downloads

Acknowledgements

This research was commissioned by RVO (Netherlands Enterprise Agency) and was carried out by the European consortia ProEME and SolutionsPlus, with FIER as lead partner in this research.

Moving zero-emission freight toward commercialization

This report analyses the commercialization potential and timeline. This is done by thorough analysis of the technological, regulatory, and financial future of zero-emission freight.

TCO zero-emission freight vehicles

The competitiveness of companies in the logistics market is largely determined by transport costs. A central requirement for the vehicles used, and thus for the market success, is therefore competitive overall costs of ZEFV applications. A competitive TCO largely determines the success and uptake of ZEFVs in the broader market.

Calculations show that the heaviest electric trucks (40-44 ton) reach a positive TCO compared to dieseltrucks, around 2030. Lighter trucks reach this point sooner.

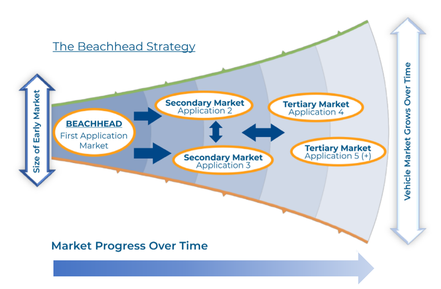

Beachhead strategy

Beachhead strategy explanation to be added

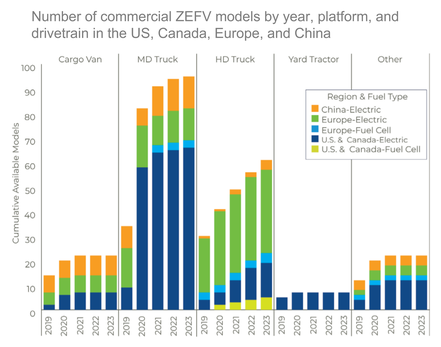

Model offering of zero-emission freight vehicles

Model increase of zero-emission freight vehicles across all continents. Especially for the trucks.